Custom Capital

Investor Platform

Two-product architecture for investor relations, deal management, and document workflows.

Why Investor Relations First

This project lays the foundation for a platform that will later expand to serve other departments across Custom Capital. We are starting with Investor Relations because it defines and supports the white-glove service Custom Capital promises and is currently delivering. It is one of the most mature, yet operationally chaotic processes at the firm — making it the ideal starting point to establish structure, demonstrate ROI, and build the infrastructure that other departments will eventually plug into.

Product Overview

System architecture, product structure, and integration design.

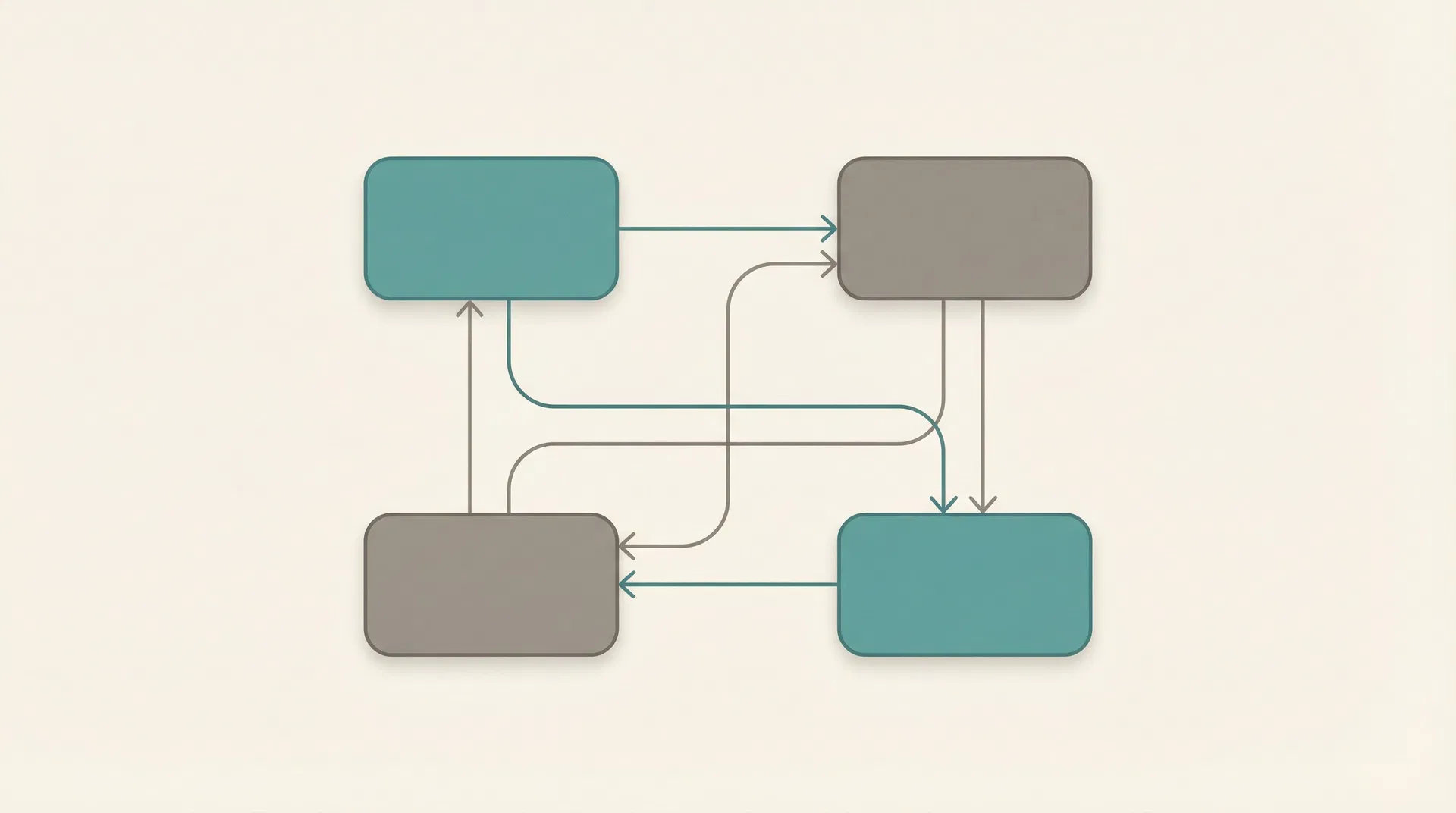

The platform is built as two complementary products sharing a single backend and database. The IR Control Panel (web app) serves the internal IR team as their primary workspace for managing deals, investors, documents, and PFS workflows. The Investor App (mobile) gives investors a clean, real-time view of their deal progress, document requirements, and signature requests.

Data enters the system automatically when a deal reaches the Investor LOI stage on Monday.com. From that point, the IR team manages the investor experience through the web portal, and their work is reflected in real time on the investor's mobile app. The system also integrates bidirectionally with Dropbox for document management and with DocuSign for e-signatures.

This is a semi-assisted starting point — not the final state. Significant automation is already built into the initial release: automatic deal ingestion from Monday.com, automated notifications, AI-powered document extraction for PFS, and real-time sync between portal and app. The manual layer exists where human judgment adds value (milestone updates, PFS review, document curation), and the architecture supports progressive automation as internal processes stabilize.

Two-Product Architecture

IR Control Panel

User: Internal IR Team

The IR team's primary workspace for managing active deals and investor relationships. Deals are auto-populated from Monday.com at LOI stage. The IR team manages milestones, reviews PFS submissions, curates documents, triggers DocuSign envelopes, and sends notifications — all from a single interface.

Investor App

User: Investors

A real-time window into the investor's active deal. Shows deal progress (Domino's-style tracker), document vault with upload capability, DocuSign signing, PFS collaborative flow, and a notification feed. All content is powered by the IR team's work in the web portal.

Data Flow

IR Control Panel

IR team manages deals, investors, documents, PFS

Investor App

Real-time deal progress, documents, PFS, signatures

Automation in Initial Release

Automatic when a deal enters LOI Executed on Monday.com — webhook triggers full data pull including 40+ columns, investor info, and Dropbox links.

Bidirectional Dropbox sync surfaces documents automatically and files uploads and signed documents back to the correct folders.

Uploaded PFS documents are automatically split, classified, extracted, and cross-referenced. Confirmation cards generated for investor review.

Automated push notifications for milestone updates, document requests, signature requirements, PFS status changes, and delay notices.

IR Control Panel

The IR team's primary workspace for managing active deals and investor relationships. Deals auto-populate from Monday.com at LOI stage; the IR team manages everything from this single interface.

Deal Dashboard

ShipAuto-populated list of active deals pulled from Monday.com at LOI stage. Each deal card shows deal info, investor(s), Dropbox link, and current status.

Milestone Management

ShipSet and update deal progress stages from a standard template. Powers the investor-facing Deal Tracker. IR team controls when milestones move and adds context for each update.

Investor Management

ShipView and manage investors per deal. Grant/revoke mobile app access. Handle joint investors within a single investing entity.

PFS Review & Directives

ShipSee PFS status per investor. Review AI-processed data, flag issues, send directives to investors, approve final PFS, and generate versioned PDFs.

Document Management

ShipView Dropbox-synced documents per deal. Flag missing items, send reminders, trigger DocuSign envelopes, and track signature status.

Notification Composer

ShipSend structured notifications to investors with templates for common scenarios. Push delivery to mobile app.

Investor Mobile App

A real-time window into the investor's active deal. Shows deal progress, documents, PFS status, and signature requests — all powered by the IR team's work in the web portal.

Onboarding Strategy

IR team triggers onboarding when a deal enters LOI stage. System sends SMS/email with download link and account setup. Investor lands directly into their deal.

Sales onboards investors earlier (after intro call). Investor has the app but sees a waiting state with company info and agent contact. When deal hits LOI/EMD, the deal materializes automatically. No architectural rework needed — account creation and deal assignment simply decouple.

Deal Tracker (Domino's Style)

ShipVisual milestone progress bar showing where the deal stands. Target dates, status notes, delay explanations — all powered by IR team updates.

Document Vault

ShipOrganized view of deal documents. Shared deal documents visible to all entity members. Private documents (PFS, financials) visible only to the individual investor.

DocuSign Signing

ShipSign documents directly within the app via DocuSign's embedded signing ceremony. WebView-based — no native SDK required.

PFS Collaborative Flow

ShipAI-guided document upload and data confirmation. Upload required documents, verify AI-extracted data, respond to IR team directives.

Notification Feed

ShipActivity timeline of all deal updates, action items, and delay notices. Push notifications for time-sensitive items.

Agent Contact

ShipDirect line to the investor's IR contact. Email, phone, and appointment scheduling. In-app chat planned for Phase 2.

Deal Tracker

Visual deal progress tracker showing investors exactly where their deal stands. Milestones, dates, status notes, and delay explanations — updated by the IR team.

Underwriting in progress

"Bank President on vacation, the committee meeting was pushed two weeks pushing back our potential timeline to closing. Next meeting scheduled for October 1st — will update once we receive approval."

Tracker adjusts dates automatically. Investor sees the reason alongside the updated timeline.

How It Works

Every deal starts from a standard milestone template (LOI → EMD → DD → Lending → Committee → Closing). IR team customizes per deal as needed.

The IR team controls when milestones move. They add notes, set target dates, and provide delay explanations with context.

Every update is instantly visible in the investor's mobile app. Push notifications sent for milestone changes and delays.

PFS Workflow

AI-powered Personal Financial Statement pipeline. Collaborative between IR team and investor — the AI extracts and classifies, the humans verify and approve.

Confirmation over interrogation. Instead of asking open-ended questions, the AI parses uploaded documents and presents pre-filled assertions: "According to your Schedule E for 2025, you have 2 rental properties with $60K total income. Is that accurate?" The investor verifies rather than filling out forms from scratch.

AI Extraction Tiers

Obvious

Auto-extract, auto-populate, no confirmation needed

- Driver's license → full name, DOB, address

- W-2 → employer name, wages

- Net worth calculation (pure math)

Confident but Confirm

Auto-extract, present as assertion, investor confirms

- Schedule E rental properties and income

- Bank statement balances

- Multiple retirement account totals

Ambiguous

Flag for IR review, may need additional docs or clarification

- Unclear business ownership percentage

- K-1 income — recurring or one-time?

- Property on Schedule E with no matching mortgage

Workflow Stages

AI Pipeline Architecture

A 160-page tax return is not processed in a single AI call. The pipeline breaks work into stages for accuracy, speed, and cost efficiency.

PDF split into logical sections. Tax returns have predictable structure: 1040 pages, then Schedule A, B, C, D, E, etc. OCR applied if scanned.

Each chunk gets its own extraction call with a specialized prompt. Schedule E → extract rental properties. 1040 Page 1 → extract income lines. All chunks process simultaneously.

Match properties to mortgages, validate income consistency, flag discrepancies, calculate net worth, classify Tier 1/2/3.

Turn structured data into natural-language assertion cards for investor confirmation.

Completion Criteria

The PFS is ready for finalization when all three conditions are met:

All required documents uploaded and processed (every card green or explicitly waived)

All Tier 2 items confirmed by investor (no pending confirmation cards)

All Tier 3 items resolved by IR team (resolved, directive-completed, or accepted with note)

Versioning & Editability

Can reopen a finalized PFS, request additional documents, manually edit values, and re-finalize (v1.1, v2.0). Previous versions preserved with changelog.

Can view current finalized PFS (read-only PDF). Cannot edit directly — all changes go through IR team. Can upload new documents at any time, triggering IR notification.

DocuSign Integration

End-to-end e-signature workflow. IR team triggers from the portal, investor signs in the mobile app, signed documents auto-file to Dropbox. Pure API — no SDK required.

Signature Workflow

Opens deal → investor profile → Documents & Signatures tab

Clicks 'New Signature Request' — uploads document, sets title, selects signer(s), adds notes

Calls DocuSign API → creates envelope → stores envelopeId → sets status to 'Sent'

Pushes notification to investor: 'New document requires your signature'

Opens app → taps document → DocuSign signing ceremony opens in WebView

Reviews and signs the document

Fires Connect webhook: envelope status → completed

Updates status to 'Signed', pulls signed PDF, uploads to Dropbox, creates version record

Notifies IR team and investor with confirmation and signed copy access

Technical Implementation

WebView / In-App Browser with DocuSign Signing Ceremony URL — no native SDK needed

Backend API calls only — IR team uses custom React UI, no DocuSign SDK on frontend

DocuSign Connect webhooks for real-time status updates. Events tracked: sent, delivered, viewed, signed, declined, voided. Each event updates status in real-time and triggers appropriate notifications.

Signed PDFs automatically filed to Dropbox via existing integration. Signed PDFs versioned in the system with full audit trail: who signed, when, from what device. Original and signed copies both preserved.

Integrations

Monday.com, Dropbox, DocuSign, and AI pipeline connections. Monday.com and Dropbox modules are already built and tested from previous projects.

Data Model

Core entities, relationships, and the privacy model that governs what investors see.

Entity Relationships

Entity Definitions

Privacy Model

Deal Tracker milestones, deal-level documents (OM, DD reports, property docs) — visible to all investors in the entity

PFS, financial documents, personal uploads, DocuSign envelopes — visible only to the individual investor and IR team

IR team can override visibility per document: make a private document shared, or restrict a shared document. Default: PFS = private, deal docs = shared.

Data & Offboarding

Investor data lifecycle management — archive, delete, and self-service account deletion.

Archive Investor

Moves investor from active to archived state. Investor loses mobile app access (app shows 'Your deal has been completed/closed'). All deal data remains visible to IR team in archived state.

Delete Investor Data

Permanently deletes PFS data, uploaded documents, extracted financial data, and AI processing results. Retains basic investor name + deal association + dates for audit/compliance. Does NOT auto-delete from Dropbox.

Deletion certificate with investor name, deal name, deletion date, and IR team member who executed.

Investor Self-Service Deletion

'Delete My Account' option in app settings. Triggers notification to IR team for review and execution. Required by Apple App Store and Google Play Store policies.

- Automated retention policies (auto-delete after X years) — policy decision, not tech

- Full GDPR/CCPA compliance workflows — unless international investors exist

- Granular document-level deletion — archive/delete at investor level is sufficient

Phasing & Roadmap

What ships in the initial release vs. what comes later. Clear separation with reasoning for each deferral.

Initial Release

Phase 2+

Engagement feature — investors already know Custom Capital

Growth feature, not core workflow

Standalone tools, not core workflow

Requires HubSpot integration and sales process alignment

Requires deal inventory management

Notification feed covers initial needs; chat is Phase 2

No practical data flow in initial release; Phase 2 for profile enrichment

Data flows in, not out, for initial release

Build Complexity Matrix

| Module | Complexity | Build Size | Reuse | Risk |

|---|---|---|---|---|

| Monday.com ingestion | Low | Small | High (built) | Low |

| Dropbox sync | Low | Small | High (built) | Low |

| IR Control Panel | Medium | Medium | Partial | Low |

| Investor Mobile App | Medium | Medium | New | Medium |

| Deal Tracker | Low-Med | Small-Med | New (straightforward) | Low |

| DocuSign integration | Medium | Medium | New (standard API) | Low |

| PFS AI workflow | High | Large | Partial (reimagined) | Med-High |

| Notification system | Medium | Medium | New | Low |

Timeline, Team, Communication & Tech Stack

6-month project plan with team composition, communication framework, and technology decisions.